Planning in 2012 (LISI Newsletter May 29, 2012)

Planning in 2012 for Clients with Shorter Life Expectancies

Leimberg Information Services Estate Planning Newsletter #1967, May 29, 2012

Republished NAEPC Journal of Estate and Tax Planning, July 2012

Copyright, 2012. John J. Scroggin, AEP, J.D., LL.M., All Rights Reserved.

“Life is pleasant. Death is peaceful. It’s the Transition that’s Troublesome.”

– Jimi Hendrix

“Anyone who says they know what the tax rules will be after 2012 is either clairvoyant or deranged!”

John J. (“Jeff”) Scroggin has practiced as a business, tax and estate planning attorney (and as a CPA with Arthur Andersen) in Atlanta for 33 years. He is a member of the Board of Trustees of the University of Florida College of Law and holds a BSBA in accounting, J.D., and LL.M (Tax) from the University of Florida. Jeff served as Founding Editor of the NAEPC Journal of Estate and Tax Planning for five years and was Co-Editor of Commerce Clearing House’s Journal of Practical Estate Planning for two years. He is the author of over 240 published articles and columns. He has been selected for inclusion in Georgia Super Lawyers and as a Five Star Wealth Advisor for the last four years. He has held an “AV” preeminent ranking from Martindale-Hubbell since 1990. Jeff is a nationally recognized speaker on estate, business and tax planning issues and has been quoted extensively, including multiple times in the Wall Street Journal. Jeff owns one of the largest collections of tax memorabilia in the U.S.

Executive Summary:

Planning for the death of a client is never an easy process, but as we near the end of 2012, that process will become more complicated and perhaps a bit macabre. Assume a terminally ill, unmarried client’s estate is valued at $10 million. His doctor comes to his children and says he can keep dad alive for a few days into 2013. Given that those few days might cost the family over $3.0 million in additional federal estate taxes, how often would the response be: “Doc … could you work with me here?“

If Congress failures to adopt new estate tax laws before the end of 2012, we will see some rather peculiar and unsavory choices. For example, if your parent is terminally ill, do you pull the plug early enough in 2012 that you are assured of a passage before year-end? Some terminally ill clients may decide to take matters into their own hands before the end of 2012.

As the national media have recently discovered, 2012 will be a year of massive gifting by affluent clients. If you are an appraiser, a tax adviser or an estate planning professional representing affluent clients, cancel those vacations you were considering for the Fall of 2012 – it is going to be a very busy year-end. You might also want to alert your staff that all Fall vacations are canceled.

Comment:

While this article focuses most of its attention on clients facing a shorter life expectancy (including the elderly, chronically ill and terminally ill), all affluent clients should consider the relevant traps and opportunities of planning in 2012. With a 20% automatic increase in the top federal estate tax rate in 2013 and an automatic reduction in the estate and gift tax exemptions by $4.12 million, the savings could be substantial.

Rather than repeating the more detailed analysis of other authors, I have cited other resources as supporting research materials. I have not tried to cover every limitation, exclusion, exception, or all of the nuances of each planning idea or trap. This article is meant to give you a multitude of planning ideas and an understanding of some of the traps. Know your client’s particular facts and research each planning idea thoroughly before rendering your advice. For simplicity, all of the calculations are rounded and the article will refer to the gift, estate and generation skipping applicable exclusion amounts as “exemptions.”

Chaos And Uncertainty

Unless Congress acts either in 2012 or retroactively in 2013, on January 1, 2013, most of the terms of the Economic Growth and Tax Relief Reconciliation Act of 2001 (“EGTRRA”), Jobs and Growth Tax Relief Reconciliation Act of 2003 (“JGTRRA”) and the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (“2010 Tax Act”) automatically expire. These expirations will substantially increase the transfer tax cost on the passage of wealth by affluent taxpayers and provide for a host of income tax increases.

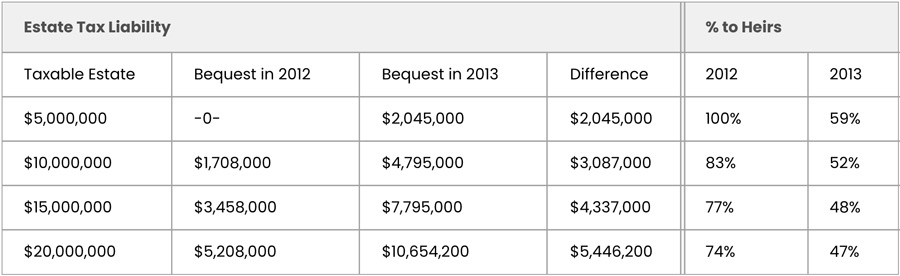

Look at the transfer tax issue in its most simplistic form. Assume the following estate values for an unmarried client, in a state without a decoupled state death tax. Assume Congress fails to change the federal transfer tax laws:

When you examine the cumulative impact of the automatic 2013 changes on the percentage of the estate passing to heirs you begin to understand why planning in 2012 is such a necessity for affluent clients, particularly those with a limited life expectancy. Notice that the larger the estate, the smaller the percentage that passes to heirs. This is because of the higher effective rate on each dollar in the estate (i.e., in 2013 the larger the estate, the more that is fully taxed at a 55% rate).

It does not matter how long the client lives into 2013. Assume a client has a $5.0 million estate. Dying in 2012 incurs no federal estate tax. But if the client dies one day into 2013, current law makes $4.0 million more of the estate taxable, with the top applicable estate tax rate increasing by 20% (i.e., from 35% in 2012 to 55% in 2013). The automatic 2013 estate tax changes create an estate tax of over $2.0 million. State death taxes in uncoupled states could drive the cost higher.

Many advisors believe that Congress will enact larger exemptions and lower tax rates than those which will automatically apply in 2013. While that is a possibility, the current political environment makes passage of permanent reform less likely. The adoption of permanent transfer tax reform will probably only occur as a part of a reform of the entire Internal Revenue Code. If Congress could not come to agreement on even moderate cuts in the increasing deficit, how likely is it that they will come to agreement on permanent reform of the entire tax code? Will they continue the politically expedient approach of just deferring the hard decisions for a few more years?

Here are a few perspectives that clients (particularly those clients with a shorter life expectancy) and their advisors should bring to the planning process in 2012:

1. Recognize that the transfer tax rules will change in 2013, either automatically or by Congressional action. We just don’t know what the post-2012 transfer tax exemptions, tax rates and other rules will be. Unfortunately, with 2012 being a Presidential and Congressional election year, there is a very strong likelihood that we will not know what the post-2012 transfer tax rules are until sometime into 2013. How the elections turn out will largely determine what the tax rules look like in 2013 and when any changes will be adopted.

- Will the losing party cooperate with the winning party to pass post-election tax changes during lame duck or will the losers tell the winners to deal with things when they get into office in January 2013?

- If the Democrats win, will they let most of the Bush era transfer tax cuts expire?

- If the Republicans win, do they cut taxes? Will they have the votes to extend the Bush era tax cuts or provide for substantial and permanent reform of the tax code?

- Even if the Republicans win the White House and control of Congress in November, it is unlikely that they will gain filibuster control in the Senate. Most provisions of EGTRRA, JGTRRA and the 2010 Tax Act are subject to an automatic termination on January 1, 2013. If the Republicans want to extend these laws (even in a modified version), they will have to overcome a probable Democratic filibuster in the Senate.

- During the lame duck session, will Washington adopt a short term extension of the current rules until later in 2013 to allow them time to come up with a different solution?

At best, any tax legislation will be adopted at the last minute as was done in 2010. Any last minute legislation is unlikely to be permanent. Moreover, if adopted at the end of 2012, most planners will not have the time to adequately study the law, advise clients and then implement any plans. Remember that the 2010 Tax Act became law on December 17, 2010 – two weeks before the end of the year and in the middle of the Christmas season.

- Rubin, “The Obama Budget Proposal and Transfer Taxes,” LISI Estate Planning Newsletter #1927 (February 21, 2012).

- Steiner “A First Look at the Administrations Revenue Proposals for the Fiscal year 2013,” LISI Income Tax Planning Newsletter #24 (February 21, 2012).

2. Because of the anticipated lack of Congressional legislation in 2012, clients may have to make decisions in 2012 without knowing what the income tax and transfer tax rules are in 2013. Effectively, they will have to plan in a vacuum of information, forcing them to “Plan for the Worst and Hope for the Best,” and resulting documents will have to be flexible enough to deal with all of the expected and unexpected possibilities.

Recommendation: Contact every estate planning client of significant means before year end by written correspondence and recommend that they come in and review their estate plan and planning documents before the end of 2012.

3. It is unlikely that Congress will retain the large federal gift tax exemptions and/or low tax rates that are currently in place. Income taxes over time will probably increase. In general, asset values are beginning to increase as we move out of the recession. The section 7520 interest rates that lie at the heart of many of the tax reduction strategies are beginning to increase. Inflation may return once the economy recovers. For a tax-adverse, affluent client with a shorter life expectancy, all of the above factors favor making significant transfers of assets in 2012.

4. At least through the end of 2012, many of the “norms” of estate planning advice will be turned on their head. For example, terminally ill clients without a taxable estate may want to develop plans to purposely increase the value of their assets if they are expected to pass in 2012, giving their heirs a larger step up in basis.

Research Source: Berkerman, “Flipping Out – The Consequences of Having The Highest Marginal Estate Tax Rate Below the Highest Marginal Income Tax Rate,” BNA Estates, Gifts and Trusts Journal, September 8, 2011.

5. Despite the chaos, waiting to see what happens next may be one of the worst things someone can do, particularly the affluent client whose passage is more imminent. For example, if the client waits until the November election, will they have sufficient time to put a plan in place? Probably not, if all of the competent estate planners and appraisers are locked up doing work for those who planned ahead. For affluent clients, failing to promptly address the planning opportunities in 2012 and the looming changes after 2012 is just plain stupid.

Research Sources on Planning in Uncertainty:

- Teitell, “Washington Legislative Climate for Charitable and Estate Planning,” Trusts and Estates, May 2012.

- Schaller & Harshman: “Why Last Chance Estate Planning May End Soon,”LISI Estate Planning Newsletter #1933 (March 1, 2012).

- Pennell, “Thoughts About Planning in Uncertain Times,” NAEPC Journal of Estate and Tax Planning, 1st Quarter 2012, which includes an analysis of the mathematics of making gifts in 2012.

- Gassman & Denicolo, “Curious Consequences of the Current Estate Tax Regime,” Estate Planning, September 2011.

- Scroggin, “Estate Planning to Cope With Legislative Uncertainty,” Estate Planning, May 2007.

Tier 1. The first tier consists of individuals or married couples who have never had much of a transfer tax problem. This client has and expects to retain a taxable estate of less than $1.0 million. Whatever happens to the transfer tax code is of little consequence to this client. Deaths in 2012 and 2013 largely have the same tax result.Client Grouping. In examining these transfer tax issues, it helps to divide clients into three primary categories, based upon the differences between the pre-EGTRRA rules and the 2012 transfer tax rules (as adopted in the 2010 Tax Act).

- Tier 2. The second tier includes individuals with an estate over $1.0 million but less than $5.0 million or a married couple with an estate from $2.0 to $10 million. This second tier is in the crosshairs of the sun-setting tax provisions. This tier bears the greatest uncertainty. “Planning for the worst and hoping for the best,” might be the best motto for this group. So what is the worst? The restoration of the 2001 transfer tax laws on January 1, 2013, with a $1.0 million estate exemption and an estate tax rate as high as 55% (i.e., the tax rate over $3.0 million) and 60% over $10 million.

- Tier 3. The third tier contains individuals with an estate over $5.0 million and married couples with over $10 million in assets. Estate taxes for this group are not going away. More than any other group, these clients should assume that their estates and/or their heirs’ estates will be subject to substantial estate taxes and income taxes and plan accordingly.

The rest of this article will focus on some (but certainly not all) of the opportunities and traps in this chaotic environment.

Planning For Clients Who Will Pass In 2012

If you know a client will pass in 2012, there are concrete recommendations you can provide, including the following:

Gifting in 2012. At first blush, it would appear that gifting in 2012 by a client who will pass in 2012would not be advisable, but this is not necessarily the case. While paying a gift tax may not make sense, gifting may still make sense in a number of situations. For example, clients should consider annual exclusion gifts and non-taxable gifts using their gift exemption as long as the gifts do not create basis problems. Discussions of gifting and basis issues in 2012 can be found later in this article.

Gifting to the Terminally Ill. Gifting to a terminally ill spouse who is expected to pass in 2012 can make sense.

Planning Example: Assume a married client is terminally ill and will clearly pass in 2012. The healthier spouse can transfer assets to the terminally ill spouse whose dispositive documents establish a testamentary Exemption Trust. To reduce the exposure to a step transaction argument, make the gift as early as possible. Use of this approach can result in:

§ Elimination of future estate taxes when the surviving spouse passes. The first to die spouse gifts up to $5.12 million to an Exemption Trust, excluding from future transfer taxes both the asset’s estate value and future appreciation, while the surviving spouse retains his or her own exemption (whatever it may be when they pass);

§ The Exemption Trust can provide for discretionary distributions of income and principal among a broad group of heirs who may be in varying income tax brackets; and

§ Asset protection can be provided for the beneficiaries (e.g., when the widower marries a woman the age of his children).

But what happens to the basis of the assets gifted by the spouse? IRC section 1014(e) provides: “In the case of a decedent dying after December 31, 1981, if (A) appreciated property was acquired by the decedent by gift during the 1-year period ending on the date of the decedent’s death, and (B) such property is acquired from the decedent by (or passes from the decedent to) the donor of such property (or the spouse of such donor), the basis of such property in the hands of such donor (or spouse) shall be the adjusted basis of such property in the hands of the decedent immediately before the death of the decedent.” The author is working on an article for LISI that will discuss the application of 1014(e) to both direct and indirect transfers for the benefit of the donor.

Charitable Gifts. Many clients make charitable bequests, but if a client dies in 2012, there may be no taxable estate (i.e., because of the high estate exemptions) or income tax benefit (i.e., because the charitable deduction is not reflected on the client’s personal income tax return) from making the charitable bequest. To obtain income tax benefits, make the charitable gift before the client’s death and take advantage of the charitable income tax deduction to reduce the client’s income taxes. Part of this plan might include accelerating income into the client’s last income tax return to take advantage of the charitable contribution. See the later discussion.

Traps: Make sure the dispositive documents are changed to remove the charitable bequests, or the charity might have a claim against the estate. Also make sure the client can fully use the charitable income tax deduction (e.g., charitable deduction limitations, AMT or itemized deduction limits could reduce the tax benefit). Research Sources: Horwood, “Imagine the Possibilities: Opportunities for Non-Cash Donors,” BNA Estates, Gifts and Trusts Journal, January 12, 2012. The article provides an excellent overview of the rules governing charitable deductions of non-cash assets, including a helpful table.

Planning Example: Replacing a $50,000 charitable bequest with a 2012 gift could save up to $17,500 in federal income taxes (i.e., $50,000 times the 35% top federal income tax rate in 2012)

Exemption Trusts. Given the uncertainty of Congressional tax actions in the next few years, clients who will pass in 2012 should strongly consider the use of Exemption Trusts rather than outright bequests. Why? The use of an Exemption Trust allows for maximum asset protection and tax protection during these times of uncertainty and effectively locks in the use of the current high transfer exemptions. See the later discussion on Exemption Trusts.

Planning Example:A married couple each own $2.0 million worth of assets. The assets are growing at an annual rate of 3%. Assume the husband died in 2012 and passed all of his assets outright to his wife who died in 2017. The husband’s death in 2012 incurs no federal estate tax. Under current law, an estate tax of $1.85 million would be due on the wife’s estate value of $4.64 million. If the husband’s entire estate had been placed in an Exemption Trust, the total assets would have the same value, but the estate tax liability on the wife’s death would be $1.26 million less.

Portability vs. Exemption Trusts. Kiplinger’s Tax Newsletter in December 2010 commented on the new portability rules pursuant to the 2010 Tax Act: “This ends the need for spouses to set up trusts in their wills just to save estate tax.” While portability can provide benefits to a client, portability as a planning tool has serious problems, including:

- Will Congress reinstate portability in 2013? Or will Congress fail to act and let portability die? If you have other options, why would you rely upon something scheduled to terminate at the end of the current year?

- Even if portability is reinstated after 2012, what will be the portable amount allowed to the surviving spouse? Will it be the unused transfer tax exemption available in 2012 (i.e. up to $5.12M) or the estate exemption permitted after 2012, reduced by the exemption used when the first spouse died? For example, if the portable exemption becomes $2.5 million and the deceased spouse had a $3.0 million estate, there might be no portable exemption. Rather than passing assets directly to a spouse and relying upon portability, an Exemption Trust would eliminate this issue.

- Portability does not extend to generation skipping tax exemptions, while an Exemption Trust can utilize the first to die spouse’s GST exemption.

- Portability does not increase in value, while future appreciation in an Exemption Trust is not subject to further transfer taxation.

- The assets placed in an Exemption Trust can be protected from creditors, including divorce and probate claims of the next spouse (e.g., dower, curtsey, years support or claims in intestacy). Placing the assets directly in the hands of a surviving spouse does not provide such protection.

- An Exemption Trust can permit income and principal to be “sprayed” to the surviving spouse, descendants and others, without further transfer tax issues. By having the Exemption Trust distribute income to taxpayers in lower income tax brackets than the surviving spouse (e.g., a child getting married), more after-tax dollars can be passed to heirs, while still providing a pool of assets to provide support for the surviving spouse.

- If a surviving spouse remarries and the second spouse pre-deceases, the unused exemption of the second deceased spouse becomes the new portable exemption. By using an Exemption Trust at the first spouse’s death, you can obtain the benefit of both deceased spouses’ exemptions.

Recommendation: The bottom line for any married client expected to pass in 2012 is to create an Exemption Trust in lieu of hoping that portability will provide as much benefit after 2012.

Trap: Even though the federal transfer tax rules permit portability, upon the surviving spouse’s passing unexpected state estate taxes could arise in “uncoupled states” because:

- The state has not adopted a statute permitting portability of a deceased spouse’s state death tax exemption, and/or

(2) The state’s death tax exemption is less than the federal exemptions.

Trap: Portability is available only if the deceased spouse’s estate timely files a federal estate tax return. But see: Lester, “The Portability Election: There May Be No Due Date for Smaller Estates,” LISI Estate Planning Newsletter #1885 (November 1, 2011). Failure to file the return can result in the portable exemption being lost. While the normal approach would be to not file a return for an estate which is below the estate exemption, advisors should quantify the benefits of portability against the cost of the return preparation and notify the clients in writing. Any decision by the client not to file the return should be clearly documented. What makes this quandary particularly unpleasant is that any recommendation by advisors to file an estate tax return will be useless if the surviving spouse dies after 2012 and Congress fails to reenact portability. Most commentators expect that some form of portability will be applicable to post-2012 planning.

Research Sources:

- Schlesinger & Goodman, “Portability: Its Limitations and Complexities,” CCH Estate Planning Review – the Journal, May 2011; Reprinted in the NAEPC Journal of Estate and Tax Planning, 1st Quarter 2012.

- Bekerman, “Portability of Estate and Gift Tax Exemptions Under TRA 2010,” BNA Estates, Gifts and Trusts Journal, May 12, 2011.

- Gassman, Crotty & Pless “SAFE Trust Guide: Why Clients Need a SAFE Trust & What To Do To Implement One By The End Of 2012,”LISI Estate Planning Newsletter #1940 (March 26, 2012).

- Shenkman & Keebler, “Ten Portability Malpractice Traps Practitioners Should Consider,” LISI Estate Planning Newsletter #1880 (October 18, 2011).

- Blattmachr, Gans & Zeydel, “The Supercharged Credit Shelter Trusts A Super Idea for Married Couples in Light of the 2010 Tax Act,” LISI Estate Planning Newsletter # 1798 (April 6, 2011).

State Transfer Taxes. Even though clients dying in 2012 may not owe any federal estate tax, advisors should keep an eye on the ever changing landscape of state transfer taxes. Many states have “decoupled” from the federal estate tax and have estate tax exemptions that are lower than the federal exemptions, resulting in the potential imposition of state death taxes even when there is no federal estate tax due.

Planning Example: Gifting assets can reduce the state estate taxes in decoupled estates. A client is dying with an estate of $4.0 million. Assume the estate exemption in her state is $1,000,000, with an effective state death tax rate of 9%. Assume the client gifted her entire estate to her heirs, using her pension, social security and long term care policy to support herself after the gift. The gift in 2012 would save her heirs approximately $270,000 in state death taxes.

Trap: If the client is domiciled in Connecticut or is gifting Connecticut based assets, make sure the gift is not subject to a Connecticut gift tax. Connecticut remains the only state in the United States to impose a gift tax. The Tennessee legislature recently eliminated the Tennessee gift tax retroactively to January 1, 2012. Louisiana (effective July 1, 2008) and North Carolina (effective January 1, 2009) have both eliminated their gift taxes.

Research Sources: Stetter, ” Deathbed Gifts: A Savings Opportunity for Residents of Decoupled States” Estate Planning, June 2004.

Planning for a Higher Basis. For clients passing in 2012, basis planning may trump estate tax planning, particularly for many clients in Tier 1 and Tier 2. If the client is going to pass in 2012 and owns an asset that will be discounted in value (e.g., because of the decedent’s minority ownership or other reasons), pre-mortem planning should include determining ways to increase the date of death step up in basis of the asset, assuming the increase in value does not create any additional state or federal estate taxes. See the later discussion in this article.

2012 Planning For Clients Who Will Pass After 2012

If the client is expected to pass after 2012, there are many tax planning opportunities and traps that need to be considered, including:

Gifting and The Unified Tax System. In making decisions about gifting, the starting point is understanding how the unified transfer tax system treats gifts before 2013 for clients who will die after 2012. This issue includes at least two elements:

- Will there be “clawback” of the transfer taxes on the 2012 gifts when the client dies after 2012?

- Even if there is no clawback, how does the inclusion of pre-2013 gifts impact the calculation of the estate tax in 2013?

Effectively, the merger of Congressional uncertainty, the potential impact of the above two issues and the potential imposition of larger transfer taxes after 2012 encourages clients who are facing an imminent death to strongly consider planning approaches that maximize their gifts in 2012.

Estate Tax Clawback on Gifts. Clawback is essentially the question of whether a client who makes non-taxable gifts before 2013, will pay a transfer tax on those gifts when the client dies after 2012. There is significant disagreement among commentators on whether current law would eliminate the potential for clawback. See the research sources listed at the end of this section for a more thorough analysis of the issue. Whether or not clawback is an issue, the general consensus is that Congress will fix the issue in new legislation, particularly if the IRS acts aggressively to impose estate taxes on previously non-taxable gifts. While there are current proposals designed to mitigate the impact of clawback (e.g., H.R. 3467), there is no certainty on whether anything will be passed and if something does pass, what the form of the new legislation will be.

However, even if clawback is not fixed, is the client any worse off? There are reasons that gifting in 2012 would make sense, including:

- The appreciation on the gifted assets are removed from the taxable estate.

- With pre-mortem planning, discounts can be applied to the gifts using tools like Charitable Lead Trusts.

- There is no expectation that clawback will create a higher tax than would have been imposed when the gift was made. If a partial clawback in enacted, the gifting of assets decreases the overall transfer tax cost to the heirs.

- If the donor survives the gift by three years, the amount of any gift tax paid is removed from the taxable estate. See the discussion below.

- Trap: If clawback does occur, one of the major points of conflict will be how any subsequent transfer taxes are apportioned. Residuary heirs who did not participate equally in gifts can become rather grumpy and contentious if they are called upon to pay the tax on prior gifts. If the taxes are apportioned to a marital share or charitable bequest, it could increase the overall taxes on the estate by reducing the marital or charitable deduction.

Research Sources

- Starbuck, “The Mechanics of Clawback, Is a $5,000,000 Gift Really a $5,000,000 Gift,” (March 2, 2011) available at www.themadisongroup.com.

- Jones, “Who’s Afraid (Gasp) of Clawback, Trusts and Estates, January 2012; Follow-up article on Trusts and Estates Website, “Response to Reader Questions, Yes Clawback is Real,” January 25, 2012.

- Jones, “Grasping Clawback Applicability &Opportunities,” LISI Estate Planning Newsletter #1925 (February 16, 2012).

- Evans “Clawback has No Teeth”, LISI Estate Planning Newsletter #1929 (February 23, 2012).

- Rubin, “Clawback – Myth or Monster (Or, Clawback for Dummies),” Rubin on Tax, March 11, 2012 found at http://rubinontax.blogspot.com.

- Lane, “The Planning Opportunities Related to Clawback,” LISI Estate Planning Newsletter #1951 (April 19, 2012).

- Pennell, “Thoughts About Planning in Uncertain Times,” NAEPC Journal of Estate and Tax Planning, 1st Quarter 2012, which contains a lengthy discussion of clawback.

- Spica, Future Perfect: “How Tense and Mood will have Declawed the Claw-Back,” Real Property, Trust and Estate Law Journal, Winter 2012.

- Impact of Prior Gifts on the Estate Exemption. Even if Clawback is fixed, there is another way that large gifts before 2012 could create an unexpected estate tax impact after 2012.

First, the unified transfer tax system has generally provided that the use of a taxpayer’s gift tax exemption during life reduces the available estate tax exemption at death. Assuming Congress addresses the issue, does it exclude all prior non-taxable gifts from the computation of the estate tax, or does it effectively apply the prior non-taxable gifts against the client’s estate exemption? If the second approach is adopted, it could mean that a client’s estate exemption may be substantially reduced or eliminated in the future if significant gifts were made before 2013.

Second, the inclusion of prior gifts in the computation of estate taxes results in the increase in the estate tax rate on the assets remaining in the taxable estate.

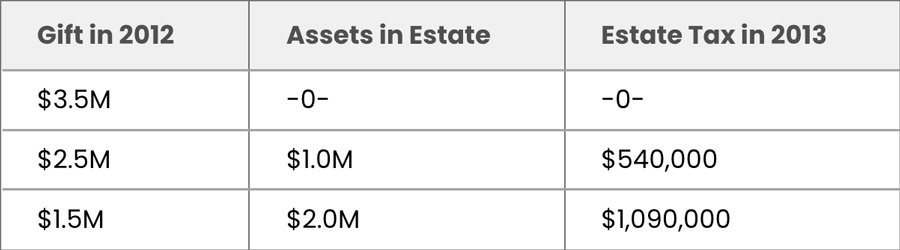

Planning Example: Assume a terminally ill client with a $3.5 million estate is considering making gifts. Assume Congress fails to act on transfer tax reform and there is no clawback. The following would be the highest transfer tax payable under various gifting scenarios

The point of these calculations is that keeping the assets in the client’s estate will increase the overall transfer tax and effectively encourages clients to consider maximizing their gifts in 2012.

Making Taxable Gifts in 2012. One of the issues which affluent clients should address is whether they should take advantage of the lower transfer tax rate of 35% in 2012 or wait to see what the transfer tax will be when they die. While the normal advice is to defer transfer taxes as long as possible, the potential 20% swing in transfer tax rates, the low section 7520 rates, and the increasing value of assets as we move out of recession (and possibility into inflation) all encourage affluent clients to consider incurring taxable gifts in 2012. This is particularly true for a client with a limited life expectancy.

Planning Example: Assume an unmarried widow has a $10 million taxable estate. She has an adequate pension and social security income stream to properly support her. She is expected to pass soon after 2012. Assume she made a net gift (see discussion below) of her entire estate in 2012. The gift tax paid by the donees would be $1.3 million. If she passed within three years of the gift, the gift taxes will be pulled back into her taxable estate and be paid by the donees.

Trap: In considering a taxable gift to a non-spouse, one of the considerations should be the impact of the donee dying within a few years of the transfer. While IRC section 2013 provides an estate tax credit for estate taxes paid by a previous decedent/owner, there is no comparable benefit for gift taxes paid. Potentially, the combination of the gift tax on the initial gift coupled with the estate tax liability upon the donee’s death could eliminate the tax benefits of the planning opportunities discussed in this article. It may make more sense to gift to a trust in lieu of a direct gift (particularly to an heir with significant health issues or who has no descendants) and give the intended initial donee a lifetime interest in the trust. The trust could provide potential estate tax savings to the donee’s heirs and asset protection to the donee.

Prepaying transfer taxes not only provides for potentially lower effective transfer tax rates, it also moves future appreciation on the asset outside the donor’s taxable estate and, if the donor survives the gift by three years, removes the amount of the gift tax from the taxable estate. As we move out of the recession and values start increasing (whether because of inflation or true value increases), the elimination of estate taxes on future appreciation could be a significant issue.

Hoarding Cash. One of the reasons that 2012 gift planning should start early is the need for many clients to start hoarding cash or otherwise obtain liquidity to pay for any gift taxes which will be due on April 15, 2013. The amount of cash the client can accumulate by April 15, 2013 may directly determine how much they can gift in 2012.

Planning Example: Assume an unmarried client owns a family business worth $40 million. Assume a 40% discount is applied to the gift of a minority interesting in the business. He wants to pass 49% of the business to children working in the company, effectively at a taxable value of $11.8 million. If the client has all of his gift exemption available, he would need to hoard about $2.4 million to pay the gift taxes. The less cash he expects to be able to accumulate by April 15, 2013, the less he should gift before the end of 2012. Assuming no growth in the value of the company and 100% is transferred at death, the estate tax savings on the 49% transfer could be $10.8 million (i.e., $40 million multiplied times 49% times at a 55% tax rate, with no discount applied). If the donor survives the gift by three years (i.e., the gift taxes paid are not included in the taxable estate), there is an additional tax savings from removing the $2.4 million in gift taxes from the taxable estate.

Portability – Use it or Potentially Lose it? A married client passes before 2013 and fails to use all of his or her available federal estate tax exemption. The unused part of the exemption carries over to the surviving spouse. As noted previously in this article, even if portability is reinstated after 2012, it is unclear how it will be calculated. Affluent clients should consider using not only their own gift tax exemption in 2012, but also any portable exemption of a predeceased spouse. Better to use the available portable exemption in 2012 than risk losing it in 2013.

Planning Example. A surviving husband has a $20 million estate and has not used any of his gift exemption. His wife died in 2011 and did not to use $3.0 million of her estate exemption. If the husband gifted $8.0 million to his descendants in 2012, the transfer would save his descendants up to $3.85 million (i.e., $7.0 million times 55%) in estate taxes (ignoring any appreciation).

On June 15, 2012, the IRS issued temporary and proposed regulations on how portability will work for a deceased spousal unused exclusion (“DSUE”). One of the more important parts of the regulation is contained in T.R. section 25.2505-2T(b) which states: “If a donor who is a surviving spouse makes a taxable gift and a DSUE amount is included in determining the surviving spouse’s applicable exclusion amount under section 2010(c)(2), such surviving spouse will be considered to apply such DSUE amount to the taxable gift before the surviving spouse’s own basic exclusion amount.” Given the uncertainty over the retention of portability in 2013, this effectively allows the use of a DSUE in 2012, with the Donor retaining his or her own exemption, even if DSUEs are reduced or eliminated in 2013.

Research Sources

- Steiner “New Portability Regulations,” LISI Estate Planning Newsletter #1977.

- Franklin & Law, “New Portability Regulations: Much Better Than Expected.” LISI Estate Planning Newsletter #1976.

Potential Tax Law Changes in 2013. Given the uncertainty of what the tax laws will be in 2013, clients should consider taking actions in 2012 to minimize the tax cost of potential changes. For example:

- With the substantial increases in federal capital gain taxes that are scheduled to take effect on January 1, 2013, clients who are considering the sale of a capital asset (e.g., a business or real estate) should consider accelerating the sale into 2012.

- Clients should consider making dividend distributions from C corporations before year end to take advantage of the low15% federal dividend tax rate.

- The Obama administration has proposed that assets held in Intentionally Defective Grantor Trusts (“IDGT”) should be included in the taxable estate of the trust grantor. The change could potentially pull Irrevocable Life Insurance Trusts (“ILITs”) into the insured donor’s taxable estate. Consider creating ILITs and IDGTs before 2013 to be grandfathered under prior law.

- With the potential reduction in the estate exemption in 2013, clients who have retained their life insurance in their own name, should consider creating ILITs in 2012 to move the life insurance out of the taxable estate and start the running of the 2035 three year rule.

- The Obama Administration has proposed requiring a minimum ten year term for GRATs. If a shorter period makes sense, get is done in 2012.

Research Sources

- Steiner, “A First Look at the Administration’s Revenue Proposals for Fiscal Year 2013,” LISI Income Tax Planning Newsletter #24

- Kitces, “President’s Budget Proposals Take Aim at Popular IDGT Estate Planning Strategy,” LISI Estate Planning Newsletter #1979

Gifting In 2012 To Minimize Transer Taxes

As noted earlier in this article, gifting in 2012 is a pivotal part of the planning for any client with a shorter life expectancy. This section will discuss some of the ways to maximize gifting in 2012.

Using Exemption Trusts. Because of the larger estate exemptions, many clients have provided that their entire estate passes to a surviving spouse with the expectation that the large estate exemptions and/or portability of the first to die spouse’s exemption will eliminate any estate tax when the surviving spouse passes. This reliance may be a mistake. Proper use in 2012 of an Exemption Trust offers a number of advantages, including:

- Minimizing the adverse tax impact of lower estate exemptions and/or higher estate tax rate after 2012.

- The assets of the Exemption Trust can grow without any additional estate tax.

- Maximizing future discretionary income and principal distributions from the Exemption Trust (i.e., income tax minimization to family members in lower income tax brackets using a “spray” power).

- Providing an indirect safety cushion for the benefit of the donor from discretionary principal and income distributions for the grantor’s spouse, until the spouse dies.

- Providing for asset protection of the assets held in the Exemption Trust for the benefit of the surviving spouse.

- Keeping the assets within the client’s bloodline (e.g., where there are children from a prior marriage, or children without any descendants).

Disposition flexibility can be added by giving the surviving spouse or someone else (e.g., if there are children from a prior marriage) a limited power of appointment over the Exemption Trust. The surviving spouse can also be a Co-Trustee and have the ability to remove and replace the other Co-Trustee(s) within certain limits.

Research Sources

- Zaritsky, “General or Limited? Some Powers of Appointment Are Just Not That Clear,” Estate Planning, November 2011.

- McCullough, “Use ‘Powers’ to Build a Better Asset Protection Trust,” Estate Planning, January 2011.

A client could each create an Exemption Trust for his or her spouse. As long as the spouse is alive and married to the donor, the donor may receive indirect benefits from the trust. Properly drafted “Spousal Access Trusts” may provide a number of benefits.

Trap: Consider providing within the provisions of any Exemption Trust that any benefits to a current spouse and their control and power of the trust (e.g. limited power of appointment or serving as a Trustee) terminate upon their divorce or legal separation from the Trust’s creator.

Recommendation: Instead of using an ascertainable standard in the trust, provide that distributions of income and principal among the named class of beneficiaries are in the absolute discretion of the trustees. Such an approach can reduce conflicts over the application of an ascertainable standard and potentially eliminate garnishment and other claims by creditors of a beneficiary.

Research Sources

- Meric, “Spousal Lifetime Access Trusts – The Good, The Bad, and The Ugly – Part I,” LISI Estate Planning Newsletter # 1334 (August 20, 2008).

- Meric & Godwin, “Spousal Lifetime Access Trusts – The Good, The Bad, and The Ugly – Part III,” LISI Estate Planning Newsletter # 1352 (October 14, 2008).

- Meric & Godwin, “Spousal Lifetime Access Trusts – The Good, The Bad, and The Ugly – Part II,” LISI Estate Planning Newsletter # 1368 (November 11, 2008).

- Gans and Blattmacher, “Another Look at Spousal Lifetime Access Trusts,” LISI Estate Planning Newsletter # 1387 (December 18, 2008).

A married couple could each create an Exemption Trust providing benefits to the other spouse and/or other heirs. However, be careful not to have two spouses create substantially similar trusts and run afoul of the Reciprocal Trust Doctrine.

Research Sources

- Steiner & Shenkman, “Beware of the Reciprocal Trust Doctrine” Trusts and Estates, April 2012.

- Meric, The Doctrine of Reciprocal Trusts – Part I,” LISI Estate Planning Newsletter #1271 (April 4, 2008).

- Meric, The Doctrine of Reciprocal Trusts – Part II,” LISI Estate Planning Newsletter #1276 (April 17, 2008).

- Meric, The Doctrine of Reciprocal Trusts – Part III,” LISI Estate Planning Newsletter #1282 (April 24, 2008).

- Meric, The Doctrine of Reciprocal Trusts – Part 1V,” LISI Estate Planning Newsletter #1332 (August 13, 2008).

Annual Exclusion Gifts. Making annual exclusion gifts in 2012 and/or 2013 may make tremendous sense, especially if the gift is treated as an advancement of a bequest under the will.

Planning Example: A terminally ill client’s will provides for 20 special bequests of $20,000 each to friends and family, with the balance going to nieces and nephews. The will provides that the residue pays any estate tax. Have the client make the $400,000 in transfers during life as annual exclusion gifts in 2012 and early 2013. Assuming a taxable estate, converting the bequests to annual exclusion gifts saves the nieces and nephews $164,000 to $240,000 in estate taxes (i.e., assuming the effective estate tax rates in 2013 are between 41% and 60%).

Trap: If advancement gifts are made, revise the dispositive documents to eliminate those bequests or have a provision in the documents that treats the gifts as an advancement of the bequest.

Planning Example: The annual exclusions should not stop with just special bequests under the will. Particularly if the annual exclusion gifts are of cash, the client should consider pre-funding residuary bequests using the annual exclusion. For example, assume an unmarried terminally client with a taxable estate passes her residuary estate equally to her eight nieces and nephews. Making annual exclusion gifts to the heirs in 2012 and 2013, could save the heirs between $72,800 (i.e., $13,000 times 8 heirs times 2 years times 35%) and $124,800 (i.e., $13,000 times 8 heirs times 2 years times 60%).

Terminally ill affluent clients should consider maximizing their annual exclusion gifting in 2012 and in early 2013. But few clients have equal sized family groups. Clients are often concerned that providing $13,000 in annual exclusion gifts to each member of his or her family will result in a disproportionate benefit to the larger families.

Planning Example: Assume a married client with three (3) children expresses concern that one child’s family with only four (4) potential donees would be detrimentally impacted because the family groups of the other children each have eight (8) donees. The donor wants all family groups to be benefited on a comparable basis and, therefore, is discussing limiting the annual exclusion to $52,000 per family group (i.e., duplicating the maximum annual exclusion gifting to the smallest family).

Instead of limiting the annual exclusion to $156,000 (i.e., $52,000 to each of the three family groups), maximize the family exclusion at $260,000 (i.e., $13,000 to 20 family members). If a married donor and spouse agree to gift splitting, the total annual exclusion could double to $520,000 ($1,040,000 over the two years). Effectively, this family could move over $500,000 each year out of their taxable estate. Among the ways to “equalize” the smaller families:

- Using some of the donors= gift tax exemption, recognizing that, while the lifetime use of the exemption reduces the available estate exemption, the use of large annual exclusion gifts increases the overall tax free dispositions to the heirs, or

- Make an equalizing special bequest under the will, with either none of the estate tax being apportioned against the special bequest, or making the special bequest on a net-after-tax basis, or

- Make gifts to a Crummey trust in which each family group has an equal beneficial interest.

In TAM 199941013 and PLR 200602002, the IRS agreed that a donor’s advance payments of tuition were excluded from gift tax pursuant to IRC section 2503(e) if the pre-payment was not refundable. The rulings offer an opportunity for clients (especially those who may die before the tuition comes due) to further reduce their taxable estate.

Research Sources

- Martz, “Practical Strategies for Funding a Child’s College Education,” Estate Planning, June 2006.

- Aucutt, “PLR 200602002 Tax Benefits of Pre-paying Tuition Confirmed,” LISI Estate Planning Newsletter #916, January 17, 2006.

Estate Inclusion of Gifts Taxes. As we noted above, making taxable gifts in 2012 may make sense for clients who will pass after 2012. One of the biggest risks of incurring a gift tax is that the gift tax can become a tax-inclusive tax if the donor/payor of the gift tax fails to survive the gift by three years. IRC section 2035(b) provides: “The amount of the gross estate… shall be increased by the amount of any tax paid under [the gift tax rules] by the decedent or his estate on any gift made by the decedent or his spouse during the 3-year period ending on the date of the decedent’s death.” Note that the date of the gift, not the date of the payment of the gift tax or the filing of the gift tax return begins the running of the three year statute.

Planning Example: Even if the donor is not expected to survive for three years, making a taxable gift may still make sense, particularly with a rapidly appreciating asset. For example, assume a taxpayer has an asset worth $1.0 million which expects to grow at 25% per year. Assume further that the taxpayer is in a 55% transfer tax bracket when he dies. If taxpayer has a life expectancy of two years, the gift would remove almost $563,000 (i.e., $1,000,000 at an annual rate of 25% grows to almost $1,563,000) in appreciation from the taxable estate, saving up to $310,000 (i.e., $563,000 times 55%) in transfer taxes.

Gift-Splitting and Gift Tax Inclusion. While gift taxes paid on gifts made within three years of death are included in the donor’s estate, IRC section 2035(b) does not include gift tax payments in the donor’s estate to the extent that the gift tax was paid by the decedent’s spouse pursuant to a gift-splitting arrangement. The relevant tax policy is that there is no incentive to restore the decedent’s estate pursuant to IRC 2035 because no assets were removed from the estate by the gift tax payment.

Planning Example: If one spouse is in poorer health than the other, consider making a gift splitting election and have the healthier spouse (assuming he or she has the available funds from their own resources) pay the total gift tax (See: PLR. 9214027). This eliminates the chance that the gift tax will be included in the unhealthy spouse’s taxable estate. What if neither spouse is in great health? Consider gift splitting and having each spouse pay half the gift tax, increasing the chance that at least one of them will survive beyond the three years.

Deferring Decisions into 2013. Are there ways to hedge your bets in 2012 until you know when the client passes and what the 2013 transfer tax rules are? Possibly.

While not much has been written on the subject, donees of gifts are permitted to disclaim their rights for the same nine month period as an heir. A married client could create a trust at the end of 2012 and transfer assets into the trust. The trust gives the client’s spouse the right to withdraw the contribution from the trust within nine months of the transfer. If the transfer tax laws are adopted within nine months (i.e. no later than the end of September 2013)of the trust contribution and those changes make the 2012 gift unnecessary, the spouse exercises the right of withdrawal and the marital gift deduction under IRC section 2523 would render the transfer non-taxable. However, if either Congress has failed to act within nine months or adopts tax laws which support the December 2012 gift, then the spouse disclaims their right and the assets pass into the trust.

Beware: The rights of the disclaiming spouse in the disclaimed trust must be restricted.

Research Sources: McDaniel, “Using Disclaimers in an Uncertain Estate Planning Environment,” NAEPC Annual Conference, November 2006.

Another alternative is the creation of an inter vivos QTIP trust. The donor can create the trust now, but defer the decision on electing QTIP status as long as October 15, 2013 (assuming the return is extended). But if the decision creates a taxable gift (i.e., deciding not to elect QTIP status), the decision should be made by April 15, 2013 in order to avoid penalties and interest on the gift tax that was due April 15, 2013.

One concern with this QTIP approach is that even if donor does not elect to treat a part of the QTIP trust as a marital deduction trust, the only beneficiary of the trust can be the donor’s spouse. To get around this issue, the trust instrument could provide that if the spouse within nine months of the trust contribution, disclaimed all or any portion of the trust, it passes to a Exemption Trust or designated individuals (e.g., GST “skip” persons). The spouse would have nine months after the funding of the trust to make the decision to disclaim, but should not receive any benefits from the trust during the pre-disclaimer period. However, the use of the “Clayton regulation” for gift tax marital deduction purposes is not entirely clear.

Research Source: Steve R. Akers, “Estate Planning in Light of One-Year’ Repeal’ of Estate and GST Tax in 2010,” at page 35, published by Bessemer Trust.

Net Gifts. Many donors are uncomfortable with the potential further depletion of their remaining estate by gifts taxes, or penalties and interest from underreported gifts. This should never be an impediment to making a major gift. Consider the use of a “net gift.” A “net gift” is a gift in which the donor, as a condition of the gift, requires the donee to pay the gift tax. The gift’s value is reduced by the gift tax to be paid by the donee because the donee’s payment of the gift tax is considered a sale, not a gift, by the donor. The amount of the gift tax (and the reduction in the value of the gift) is determined by a formula of: the tentative gift tax divided by the sum of one plus the rate of tax. In Revenue Ruling 80-111 (1980-1 CB 208), the IRS noted that any state gift taxes which were assumed by the donee can also be taken into account to reduce the gift value.

Planning Example: Assume an unmarried donor who has retained all of his gift exemption, makes a $10 million gift in 2012 to a donee, and the donee is obligated to pay the gift tax on the transfer. The gift tax on the “net gift” is $1,265,185 – an effective transfer tax rate of 12.65%.

Trap: Make sure the donor and donee both sign a comprehensive document that fully documents each of their responsibilities for the applicable gift. For example, if the donor dies within three years of the gift, is the donee liable for payment of the additional estate tax from the inclusion of the gift tax in the donor’s taxable estate?

Because part of the net gift transaction is treated as a sale transaction the donor may recognize taxable income from sale portion of the transaction. How do you compute the taxable gain from the sale? Treasury Regulation section 1.1001-1(e)(1) provides that “Where a transfer of property is part a sale and in part a gift, the transferor has gain to the extent that the amount realized by him exceeds his adjusted basis in the property.” As confirmed by the examples in the above regulation, the entire basis (not a just an amount proportionate to the sale part of the transaction) is used to compute the donor’s gain, effectively reducing the gain to zero, unless the gift taxes paid by the donee exceed the donor’s total adjusted basis in the gifted property.

The nature of a net gift is a part sale/part gift transaction. This creates some interesting basis issues for net gifts. Pursuant to IRC section 1015(d)(6), to the extent that gift tax is paid on the donor’s appreciated value in the gift (i.e., not the entire gift tax paid), the donee’s basis in the gifted asset is increased to a value which does not exceed the property’s fair market value. But if the donee pays the gift tax, what happens? Logically, you would think that the donee’s payment of the donor’s tax could not be taken into account because the donee’s payment is considered a sale and to permit a second basis adjustment would effectively be “double-dipping.” However, IRC section 1015(d)(6) reads: “In the case of any gift made after December 31, 1976, the increase in basis provided by this subsection with respect to any gift for the gift tax paid under chapter 12 shall be…” (emphasis added). Does this mean that the increase in basis is still permitted? Treasury Regulation section 1.1015-4 reads: “Where a transfer of property is in part a sale and in part a gift, the unadjusted basis of the property in the hands of the transferee is the sum of (1)Whichever of the following is the greater: (i) The amount paid by the transferee for the property, or (ii) The transferor’s adjusted basis for the property at the time of the transfer, and (2) the amount of increase, if any, in basis authorized by section 1015(d) for gift tax paid…” (emphasis added). On the sale portion of the transaction, there is an increase in the donee’s basis to the extent the donee purchased a part of the transferred asset. Thus, the donee may obtain a higher basis than would have been obtained from a straight gift when there is an unrecognized appreciation in the gifted asset’s value.

Trap: There are numerous traps in the use of net gifts. Make sure you understand all of the implications before recommending a net gift to your clients.

Trap: Any time a net gift is made, the donees need to be comfortable that any joint and several liability will be allocated among them based upon relative benefits received. Until the audit statue of limitation closes, that liability remains open. If one donee squanders their gift, the others may be left holding the tax bag. It might make sense to provide that the assets (but possibly not the income) are held in trust until any donee liability for the gift tax has expired.

Research Sources

- Scroggin and Douglas, “Should Your Clients Consider Gifting Before the End of 2010?” LISI Estate Planning Newsletter #1668 (July 1, 2010).

- Arlein & Frazier, “The Net, Net Gift,” Trusts and Estates, August 2008.

- Akers, “Steve Akers Revisits McCord,” LISI Estate Planning Newsletter #1016 (September 5, 2006).

- Hood, “McCord – Fifth Circuit Reverses Tax Court,” LISI Estate Planning Newsletter #1010 (August 23, 2006).

Discounting Family Debt. As a consequence of estate planning and other family planning, many clients have created intra-family debt (e.g., an installment sale of a family business interest to an income defective trust). Rather than leaving the debt in the estate of the older generation, clients should consider a forgiveness of the debt on a net gift basis – effectively treating a net gift arrangement as a discounted pay-off of the note. Here’s the basic question to ask the reluctant client: “If you could satisfy a debt for a fraction of its face value, while eliminating a potential estate tax of up to 55% of the debt, why would you NOT act?”

Planning Example: Assume an unmarried client has completed a sale of a real estate LLC using a $10 million note to a trust for his children. The client agrees to forgive the note if the trust will pay the gift tax. Assuming the client has not used any of his gift exemption, the gift tax on the net gift value would be roughly $1.3 million. The trust could obtain a loan from a commercial lender to cover the gift tax liability, or borrow the funds from the donor.

Trap: The gift of an installment sale note can create the immediate recognition of the taxable gain in the note. See: IRC section 453B and Revenue Ruling 79-371, 1979-2 C.B. 294. Of course, this is a problem only to the extent there is deferred taxable gain in the unpaid balance of the note.

Charitable Discounting. Whenever the client is considering a taxable gift or bequest, the advisor should consider methods that will discount the value of the transferred asset. This may be particularly important given that discounts for intra-family transfers may be restricted in the near future. Given that section 7520 rates are at historic lows, advisors should consider using techniques that include charities (e.g., Charitable Lead Trusts). Such techniques work particularly well when the asset gifted to the CLT has a cash flow that significantly exceeds the then current section 7520 rates.

Planning Example: A charitably inclined donor has an asset worth $10 million which is growing at a steady 12% annual rate. The donor wants to see assets pass to the benefit of her grandchildren, starting in 10 years. In May 2012, she creates a Charitable Lead Annuity Trust with the entire asset and provides for a $540,000 annual payout to the charity. The value of the taxable gift is $5.0 million and in ten years the payout to the grandchildren’s benefit is calculated to be approximately $21 million.

Research Sources

§ Katzenstein, “7520 Rate Drops Opens Up Charitable Planning Opportunities,” LISI Estate Planning Newsletter #167 (November 30, 2010).

§ Fox, Low 7520 Rates Put Focus on Charitable Lead Trusts, LISI Charitable Planning Newsletter #158 (August 3, 2010).

Assignments and Marital Trusts. Clients with marital trusts that will be included in their taxable estates should consider how they can transfer trust interests in 2012, while the higher exemptions prevail. Among the alternatives:

- If the trust provides for broad discretion in the Trustee to make distributions, the Trustee may be able to take into account the potential tax consequences (particularly those to the remaindermen) and make a distribution to the surviving spouse, who then makes a gift to his or her heirs.

- The surviving spouse could gift his or her life interest to the remaindermen and the merger of the life interest with the remainder interest in the trust could cause the marital trust to expire. IRC section 2519 provides that the transfer of a QTIP life estate is treated as a gift of the entire trust interest, not just the surviving spouse’s life interest. The principal problem with this approach is that it may force a direct distribution to the remaindermen and this may not be the best choice (e.g., an heir with a disability, or creditor claims).

- In the alternative, the remaindermen could sell or gift their remainder interest to the surviving spouse and merger could result in the spouse owning the entire interest. The spouse would then be free to dispose of the trust interests in the most efficient manner. See: Rev. Rul. 98-8, 1998-1 C.B. 541, which holds that the purchase by a surviving spouse of a marital trust’s remainder interest is treated like a gift of the spouse’s life interest in the marital trust.

Trap: In a recent decision (Estate of Anne Morgens v. Commissioner), the U.S Court of Appeals for the Ninth Circuit affirmed a Tax Court opinion that any gift tax resulting from the transfer of a marital trust interest is included in the surviving spouse’s taxable estate if the surviving spouse dies within three years of the gift. The Estate argued that because the marital trust was legally responsible for the payment of the gift tax, the gift tax inclusion should not apply to the Estate. If the recipients of the gift of the marital trust differ from the beneficiaries of the surviving spouse’s estate, advisors should consider obtaining an indemnification agreement from the recipients of the gift.

Research Sources: Jones, “Estate of Anne Morgens: QTIP Gift Tax Held Includible in Estate of Surviving Spouse & What It Means for Planners,” LISI Estate Planning Newsletter #1961, (May 15, 2012).

Trap: If state law limits the right of assignment of trust interests, if the trust instrument contains a spendthrift clause (or other limits on the right of alienation of a beneficial interest) or there are no vested remaindermen to the QTIP until the spouse passes, using merger of beneficial interests may not be viable.

Research Sources

- Stephens, Maxfield, Lind, Calfee & Smith, Federal Estate and Gift Taxation (WG&L), section 10.08, The Disposition of Certain Life Interests.

- Zaritsky, “PLR 200044034 Division of QTIP to Facilitate Gifts,” LISI Estate Planning Newsletter 205, November 16, 2000.

- Atherton & Mitchell, “Potential Planning Strategies for Monetizing a QTIP trust,” Estate Planning, May 2002.

- Bramwell, “Using Section 2519 to Enhance Estate Planning with QTIPs,” Estate Planning, October 2011.

- Deathbed Gifting. Deathbed gifts can be a significant planning tool. However, in Revenue Ruling 96-56 (1996-2 C.B. 161) the IRS ruled that if the donor dies before annual exclusion gift checks clear his or her account, the gift is not removed from the taxable estate. In general, charitable death bed checks do not have to clear the decedent’s accounts before death, while non-charitable gifts do have to clear the account to be completed. Bottom line? Make sure any checks clear the donor’s account and that delivery of any documents (and appropriate recording, such as real estate deeds) occurs before the donor passes. See also: Metzger v. Commissioner, 38 F.3d 118 (4th Cir. 1994).

Research Sources: Pomeroy & Abbott, ‘Deathbed Opportunities.” Trusts and Estates, June 2007.

Retaining an Income Stream for Donors. When affluent clients are considering substantial gifts, a significant issue is how do they retain sufficient assets and income to support themselves for the remainder of their lives? This is normally the single most important impediment to making substantial gifts. Here are a few ideas that should be considered:

- Cash Flow Projection. Run a cash flow projection of the client’s current lifestyle costs and sources of cash flow (i.e., cash flow may differ from income). Provide a “cushion” by increasing the initial cash flow projections by a stated percentage (e.g., 50%) and by increasing it annually by a set percentage (e.g., 5%). If there are asset sources (e.g., Exemption Trusts) in which the principal can be used for the donor client, consider annuitizing the principal value in your calculations to show the client how long their cash flow needs could be meet, even if they give away a substantial part of their assets. Prioritize the source of funds by first depleting those assets which would otherwise be included in the donor’s taxable estate (e.g., consider depleting the IRAs before the Exemption Trust created by a deceased spouse).

- Retirement Plans. Because the gifting of retirement plans and IRAs would accelerate the income taxes on the plan assets, there is generally no benefit to gifting them. Because of the potential double taxation at higher tax rates after 2013 (i.e., estate tax rates and income tax rates may automatically increase), depleting retirement assets during the client’s remaining life may make sense. If the client is charitably inclined, they could provide a beneficiary designation that passes the remaining retirement plan assets to qualified charities. Compare that plan to the benefit of using a stretch IRA.

- Using Existing Non-Taxable Trusts. Existing trusts may provide security to the donor that the donor will not be left destitute after the gifts. Show clients how long the income and principal of the existing Trusts could support them at their current use of funds.

Planning Example: Assume an 90 year old widow is in very poor health. She has $1.3 million in an Exemption Trust created by her deceased husband and owns $3.5 million in her own name. Consider a gift of her entire estate in 2012 and rely upon the Exemption Trust to support the spouse till she passes. As noted in earlier in this article, if the client gifted $2.5 million and the estate exemption at her death was $2.5 million, the remaining $1.0 million (and the appreciation on it) would probably create an estate tax. This $1.0 million tax cost is avoided by gifting $3.5 million in 2012.

- Using Existing Marital Trusts. Because a marital trust will be included in the taxable estate of the surviving spouse, it can be an excellent cash flow source if the surviving spouse has gifted substantially all of his or her personal assets. Look at annuitizing the marital trust to provide income and principal distributions for the surviving spouse’s lifetime, effectively depleting the trust over time and reducing the estate taxes which may be due at the surviving spouse’s passing.

- Long term Care and Other Insurance Benefits. Determine what insurance benefits the client has and how to most effectively use them for their benefit. For example, should the client borrow against the cash value of a life insurance policy to provide support? What long term care insurance benefits does the client have?

- Creating Exemption Trusts. As discussed previously, the client can create an Exemption Trust for the benefit of a spouse and indirectly receive benefits from the trust as long as the spouse is alive and married to the donor.

- Terminating Cash Flows. Techniques which terminate at or before the death of the client offer the ability to provide a supporting cash flow, without the inclusion of an asset in the client’s taxable estate. These techniques can support significant gifting by the client. Look at techniques that have already been adopted or create new tools that provide a terminating cash flow to the client, such as:

- Private Annuities

- Insurance Annuities

- Self Cancelling Installment Sale Notes

- Short Term Installment Sale Notes

- Deferred Compensation

- Charitable Remainder Trusts

- Existing Revenue Sources. Look at existing revenue sources and see if the income can be increased. For example:

- Accelerating the payment of any installment sale notes

- Increasing rental income from a related party (e.g., dad owns the building that his children use for their business).

- o Increasing withdrawals from Retirement Plans and IRAs.

Planning for an Heir’s Future Taxes. Do the client’s current documents reflect the tax realities of 2012 and the changes in 2013? For example, if all of the assets are designed to pass to the surviving spouse (e.g., because the estate is a Tier 1 estate or the client anticipated higher estate exemptions), the client should consider the impact of a restoration of the 2001 transfer tax laws in 2013. Full use of each spouse’s transfer tax exemption may become substantially more important.

Trap: Many married clients, particularly those in Tier 1 and at the lower ends of Tier 2, have provided that all of their estate passes directly to the surviving spouse, with the marital deduction eliminating any estate tax on the first death. The expectation is that the second to die spouse’s estate is protected from estate tax by a larger estate exemption. While this approach may work when high estate exemptions are in place, the potential reductions in the estate exemptions could create unnecessary taxes. Equalization of assets and the use of Exemption Trusts may become more important.

Research Sources

§ Jones, “Drafting Estate Plans in 2010,” LISI Estate Planning Newsletter #1670 (July 6, 2010)

§ Akers, “Questions & Answers on the Lapse of the Estate and GST Taxes in 2010,” LISI Estate Planning Newsletter #1564 (December 21, 2009).

Clients should also consider the impact of the 2013 changes on their heirs. Treat the high exemptions in 2012 as not just a planning opportunity for the client, but also as a way to grow assets in the future for heirs, without incurring any additional transfer taxes. Point out to clients that their bequests and any post-transfer increases in value to descendants will sit on top of the descendants’ own assets – effectively being taxed at the highest applicable tax rate.

Planning Example: Assume a terminally ill unmarried client with a $4.0 million estate has a son with 4 children and a daughter with no descendants. Assume the daughter died ten years later, when her share of the inheritance was worth $3.4 million. Bequeathing assets to a generation skipping trusts provides a number of benefits, including:

- Saving the family up to $1.87 million (i.e., $3.4 million times 55%) in estate taxes (assuming Congress fails to act). Post-2012 changes in the estate exemption and tax rates should have no tax impact on the passage of the trust’s wealth.

- The assets stay in the family bloodline (e.g., they will not pass to the daughter’s husband, who then passes them to a second wife).

- The children could be given Limited Powers of Appointment to decide how and when the assets of their respective trusts pass to their parent’s descendants and/or charities.

- With proper terms, the trust can protect successive generations of descendants from creditors and divorcing spouses.

- Planning for future transfer taxes is particularly important for unmarried couples.

Planning Example Assume a client with a $4.0 million estate has lived with a partner for 20 years, but is not married. If the client dies in 2012, he can pass all his assets to an Exemption Trust and be assured that no estate taxes will be imposed upon the partner’s death. In the alternative, if the estate passes directly to the partner, up to $1.5 million in estate taxes may be due when the partner dies after 2012 (ignoring any appreciation). The use of an Exemption Trust also permits a reduction or an elimination of partner benefits from the trust if certain conditions occur, such as the partner getting married. In addition, by using an Exemption Trust, the first to die partner could control the ultimate disposition of the trust assets (e.g., passing them to children from a prior marriage).

Research Sources on Gifting:

- Pennell, “The Advantages of Year End Gifting,” LISI Estate Planning Newsletter #1718 (November 29, 2010), which discusses gift planning opportunities at year end.

- Racanelli, Anderson & Siow, “As Good as it Gets,” Trusts and Estates, November 2010, which provides an excellent discussion of the math of gifting.

- Evans, “The Less-Than-$1,000,000 Gift Tax Exemption” LISI Estate Planning Newsletter #1704.

§ Scroggin and Douglas, “Should Your Clients Consider Gifting Before the End of 2010?” LISI Estate Planning Newsletter #1668 (July 1, 2010).

§ Kroch, Barwick, Dicarlo, “Taking a Fresh Look at Lifetime Gift Planning Opportunities,” Estate Planning, September 2011.

- Blattmachr & Blattmachr, “Efficient Use of the Temporary $5 Million Gift and GST Tax Exemptions Redux,” NAEPC Journal of Estate and Tax Planning, 1st Quarter 2012.

Basic & Value Planning.

Basis planning should be a core part of any planning program in 2012. Not only should clients be alert to the negative consequences of gifting low basis assets to heirs, but advisors should look for ways to use the basis rules to minimize income taxes.

The Gift Basis Rules. In general, the donee of a gifted asset obtains the tax basis of the donor. IRC section 1015(a) provides: If the property was acquired by gift …, the basis shall be the same as it would be in the hands of the donor … except that if such basis … is greater than the fair market value of the property at the time of the gift, then for the purpose of determining loss the basis shall be such fair market value. The result of this rule is that the donor’s appreciation on the gifted asset will normally be taxed to the donee and the reduction in the value of gifted asset may be lost as an income tax benefit for the donee.

If the donor’s basis in the asset exceeds its fair market value, the rules get a little more complicated for the donee. If the donee subsequently sells the asset for a gain, the donee uses the donor’s basis in the property. See Treasury Regulation section 1.1015-1(a)(1)). If the donee sells the asset for a loss, the fair market value of the donated assets is used as the basis. Thus, if the donee sells for a price between the fair market value and the donor’s basis, neither a loss nor a gain is incurred. See Treasury Regulation section 1.1015-1(a)(2). Unlike a gift, the basis of an asset transferred at death is generally the asset’s fair market value, even if the fair market value is lower than the asset’s date-of-death basis.

Planning Example: Because of the recent economic downturn, many terminally ill clients own assets that have lost significant value. Part of the planning for such clients should focus on retaining the higher basis for heirs. Assume a terminally ill married client owns an asset with a basis of $500,000 and a fair market value of $200,000. If the client dies, the asset’s basis will step down to its fair market value, resulting in the termination of the tax benefit of the loss in the value of an asset. Instead, the terminally ill client could gift the asset to an heir. If the heir subsequently sells the asset for a value from $200,000 to $500,000, no taxable gain will be reported on the sale.

Planning Example: Assume a client owns marketable stock she purchased for $14,000 which is now worth $10,000. If the stock is gifted to a child and the child sells it for $10,000, the $4,000 capital loss is effectively lost. Instead, have the client sell the asset for $10,000 and take a $4,000 capital loss. The $10,000 in cash proceeds could then be gifted to the child.

The Estate Basis Rules. To the extent assets are includible in a taxable estate, the assets generally obtain a step-up in basis to the assets’ fair market value determined at either the date of death or the alternative valuation date. There are a number of exceptions to the step-up in basis rules, including property which constitutes income and respect of a decedent (“IRD”), S corporation stock and partnerships to the extent assets of the entity would have constituted IRD if held directly by the deceased shareholder, and, according to the IRS, net unrealized appreciation in employer stock distributed from a qualified retirement plan before the death of the participant (see: Revenue Ruling 75-125, 1975-1 CB 254).

Pursuant to 1014(e), if an appreciated asset was acquired by the decedent within one year of death and is bequeathed to the donor or the donor’s spouse, the decedent’s basis in the asset does not step-up to its fair market value. Instead, the beneficiary takes the decedent’s basis in the asset.

Basis Planning in 2012. For clients who will die in 2012, basis planning (in the absence of a taxable estate tax) takes on a new significance. While in the past the primary focus in estate tax driven valuations has been to minimize the value of the bequeathed or gifted asset, in 2012 driving up the value of assets may make sense. At least for 2012, practitioners may adopt the valuation arguments of the IRS (“you know dad retained too much control over the FLP so, under 2036 we have pulled the entire FLP value into his estate“). Meanwhile, the IRS may use the tax practitioners’ previous arguments supporting a lower value. And then we may all go back to our old positions on January 1, 2013.

Planning Example: Assume that in 2012, a terminally ill client owns 40% of a business having a fair market value of $4.0 million. The estimated valuation adjustments are 30%. The client’s sole heir owns the remaining 60% of the business. The client’s remaining assets are $200,000. When the client dies, the tax basis in the 40% business interest would become $1,120,000. Assume instead, the client purchased a 15% minority interest from the heir for a note. At the client’s death, his 55% interest is worth at least $2.2 million (perhaps more if a control premium is applied). The note and remaining assets would produce a non-taxable estate of $1,980,000, while providing a step up in basis for the 55% interest to $2.2 million. Assuming the heir sold the business after the client’s death, the new step-up in basis would save up to $216,000 in capital gain taxes, assuming a 20% applicable rate. However, there could be an income tax cost to the heir who sold the 15% interest.

Does it make sense to bust strategies that were designed to discount values if the client has a non-taxable estate in 2012?